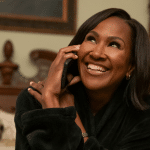

They support the idea of eliminating the income tax, but the devil is in the details. That’s the opening line of a statement released yesterday by the State Director of the National Federation of Independent Business, Dawn Starnes McVea.

According to McVea, “HB 1439 would end up helping some small business owners but raising taxes on specific industries such as manufacturing and farming. In addition, it would increase the cost of doing business in Mississippi by increasing the sales tax on business inputs such as equipment.”

“The version of the bill that passed the House last Wednesday appears to do as much harm as good. We will continue to work with legislators in both chambers to thread the needle and try to find some common ground on a final bill that doesn’t pick winners and losers but helps all small businesses.”

—

Speaker of the House Philip Gunn has said he knows changes may need to be made to the bill. “We have the ability to modify this. The legislative process is what it is, it’s a process. The deadline for passing this bill is about a month away, so there’s no reason for this bill not to continue through the process.”