Lawmakers in D.C. have already passed two response packages in the midst of the coronavirus pandemic and work is underway on a third.

The Coronavirus Aid, Relief, and Economic Security (CARES) Act of 2020 is a $1 trillion dollar aid package aimed at stabilizing the economy and curbing the effects that the virus has had on businesses and workers across the country.

The bill includes a $1,200 payment to Americans with incomes of $75,000 or less, $300 billion for small businesses and $208 billion in loans for American industries.

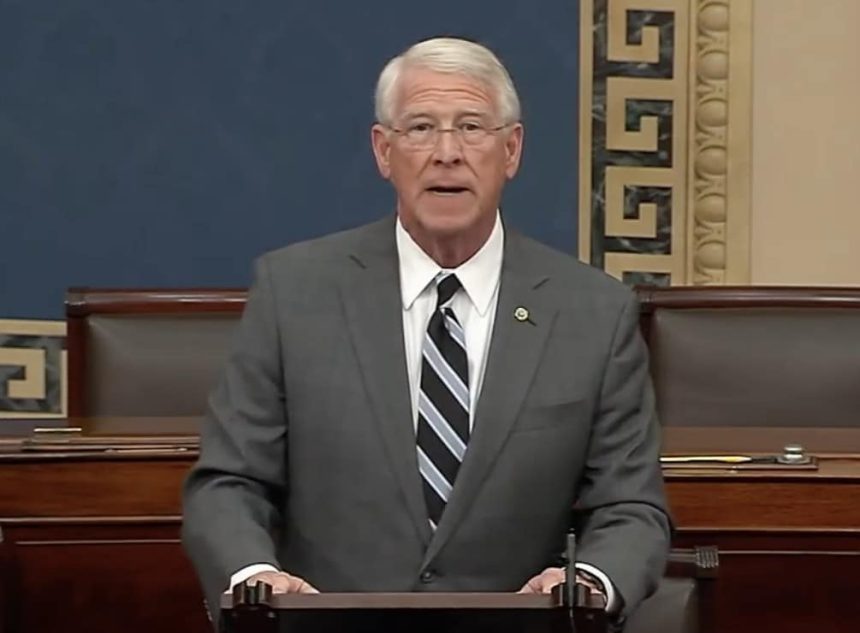

Senator Roger Wicker, chairman of the Senate Committee on Commerce, Science, and Transportation, unveiled the portion of the bill which “allows the Treasury Secretary to provide up to $208 billion in collateralized loans and loan guarantees to American industries whose operations are jeopardized as a direct result of the coronavirus outbreak.”

Wicker announced the legislation along with Richard Shelby, R-Ala., chairman of the Senate Appropriations Committee, and John Thune, R-S.D., Senate Majority Whip.

“The global coronavirus pandemic requires strong and decisive action from the federal government,” Wicker said. “During this time of unprecedented economic uncertainty, it is critical that air carriers and other impacted industries have the resources they need to continue operations. This recovery package would support the hard-hit workers and businesses who bear no responsibility for this crisis.”

In a news release, Wicker stated that $58 billion is allocated to facilitate liquidity in the airline sector, and an additional $150 billion is provided for the same purposes in other distressed sectors of the American economy. The legislation does not provide grants to or bailouts for the airlines or other industries.

On the Senate floor, Wicker spoke in support of the bill.

For small businesses, the $300 billion would provide cash-flow assistance through 100 percent federally guaranteed loans to employers who maintain their payroll during this emergency.

This portion of the bill was introduced by Senator Marco Rubio, Chairman of the Senate Committee on Small Business and Entrepreneurship, who stated that “if employers maintain their payroll, the loans would be forgiven, which would help workers to remain employed and affected small businesses and our economy to quickly snap-back after the crisis.”

The first of the relief packages provided $7.76 billion to the U.S. Department of Health and Human Services, and the second expanded the availability of testing as well as expanded unemployment, food assistance, and paid leave benefits.