The Atlantic hurricane season is officially over with November 30th marking the end of a particularly devastating season that produced six major hurricanes at a Category 3 level or higher and the National Hurricane Center has classified 2017 as one of its top seven most active hurricane seasons.

The storms affected millions of Americans, flooding homes and leaving communities in ruin. Hurricane Harvey’s torrential rain over southeast Texas broke historical records. Our own Gulf Coast communities suffered damaging floods from the storm surge of Hurricane Nate.

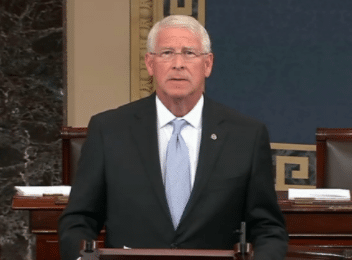

U.S. Senator Roger Wicker says that the National Flood Insurance Program (NFIP), which is used by some five million Americans who live in coastal or flood-prone areas, is coming up on a critical deadline.

The NFIP was created by Congress almost 50 years ago and often serves as the only flood insurance option that Americans have to protect their homes and property. In recent years, however, major storms like Hurricane Katrina and Hurricane Sandy have put the program’s long-term sustainability at risk. Even before Hurricanes Harvey, Maria, Irma, and Nate arrived, NFIP had amassed nearly $25 billion in debt.

Wicker said that congressional reauthorization is needed by December 8th and that he is working on reforms within the program to help keep flood insurance accessible and affordable and he has written four bills to improve the program.

“I turned to the expertise of local officials, industry leaders, and Mississippians when writing the four bills I have introduced to improve NFIP,” said U.S. Senator Roger Wicker. “I have also consulted with the National Oceanic and Atmospheric Administration (NOAA) and the Mississippi Insurance Department. These are policies that can have a major impact on Mississippians’ lives, and I am determined to ensure that they work in the best interest of our homeowners, small business owners, and communities.”

Wicker added that one of the bills would build on his “COASTAL Act which became law in 2012.

“That legislation addresses the disputes that can arise over whether properties have been damaged by wind or water,” said Wicker. “Specifically, it requires that scientific data be used by insurance adjusters for making accurate damage assessments. My new bill would update the “COASTAL Act” and offer technical support to NOAA in an effort to expedite implementation of the law.”

He said that he has support from others in Washington as well.

“I asked President Trump’s nominee for NOAA Administrator, Barry Myers, about the “COASTAL Act” during a recent Senate Commerce Committee hearing,” said Wicker. “I was glad to hear his support for the law’s implementation. Accuracy in post-storm assessments is key to providing fair compensation to homeowners and eliminating unnecessary financial burdens on NFIP.”

Wicher said that he has also introduced legislation to empower communities and residents who face flood risks.

“One of these legislative measures would enable small businesses and nonprofits with multiple structures to reallocate insurance surcharges toward flood mitigation,” said Wicker. “Another proposal would ensure that Light Detection and Ranging (LiDAR) technology is used during the flood mapping process, replacing the archaic maps for some communities in Mississippi. Modernized data can help lower premiums for consumers. A database allowing this information to be shared among federal agencies, states, municipalities, and private partners can save taxpayer dollars. Because consumers deserve the most up-to-date information, I have introduced an additional proposal that would promote continuing education opportunities for insurance agents to stay informed on the latest flood data.”

Wicker continued saying that the changes are much needed.

“I will continue to work with my colleagues on flood insurance reform and hope we can make significant strides soon,” said Wicker. “The storms of the 2017 hurricane season have demonstrated the extreme devastation that can be wrought and the need to prepare long before the next disaster hits.”