In a 224-201 vote, Congress sent the $1.5 trillion tax reform bill to President Donald Trump’s desk.

U.S. Senator Thad Cochran said his vote for the most significant federal tax reform in more than 30 years represents his optimism that the economy will grow as Mississippi families and small businesses keep more of their hard-earned income.

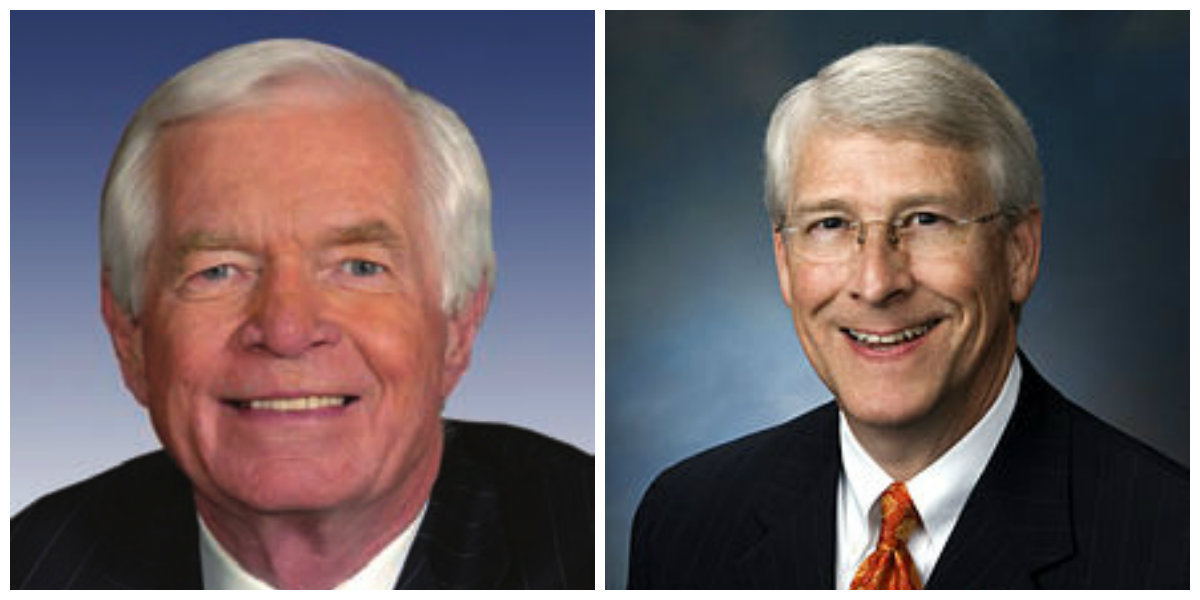

Both Senator’s Thad Cochran and Roger Wicker voted final Senate passage of Tax Cuts and Jobs Act of 2017, which passed on a 51-48 vote early Wednesday morning. President Trump has pledged to sign the bill into law. The measure will cut tax rates for individual taxpayers, overhaul small business taxes, and lower the corporate tax rate.

The early morning vote in the Senate came hours after the GOP passed the bill in the House with 227 votes in favor of the bill and 203 against.

However, there was a hiccup. The house had to re-vote because of some procedural flaws in the chamber’s vote Tuesday. The massive bill was hauled back across the Capitol for the House to vote on it again Wednesday.

“This landmark legislation will help our economy grow. Importantly, this bill lowers personal tax rates, which will allow most individuals and families in Mississippi to keep more of what they earn,” Cochran said. “I am optimistic that small businesses in Mississippi will take advantage of incentives in the bill that can help them grow. Corporate tax reforms will help companies be more competitive globally, invest more at home, and hire more American workers. I look forward to the bill becoming law.”

The bill is a negotiated compromise between House and Senate-passed legislation. The final agreement nearly doubles the standard deduction for individual and joint tax filers. It expands the Child Tax Credit and preserves tax credits for child and dependent care, and adoption.

The bill eliminates the Obamacare individual mandate and associated penalties.

Enactment of this bill would permanently reform the tax code for small businesses and corporations. It includes a tax deduction to lower the marginal tax rate applied to pass-through business income for small businesses. For corporations, the bill lowers the tax rate to 21 percent and includes provisions to prompt American corporations to create more jobs at home.

U.S. Senator Roger Wicker added that he voted for the bill as well.

“Working with President Trump, Congress has successfully overhauled the tax code to make it simpler, fairer, and smarter,” Wicker said. “Starting next year, Mississippi families will begin to see more take-home pay and an economy that continues to pick up steam. Job creators and small businesses – the lifeblood of our economy – will have more capital to invest and innovate. This is a big win for the American people built on conservative principles.”

The Senate just passed once-in-a-generation #TaxReform. We are one step closer to delivering tax cuts and much-needed relief to families across America. pic.twitter.com/wBrAMGPYnL

— Senate Republicans (@SenateGOP) December 20, 2017