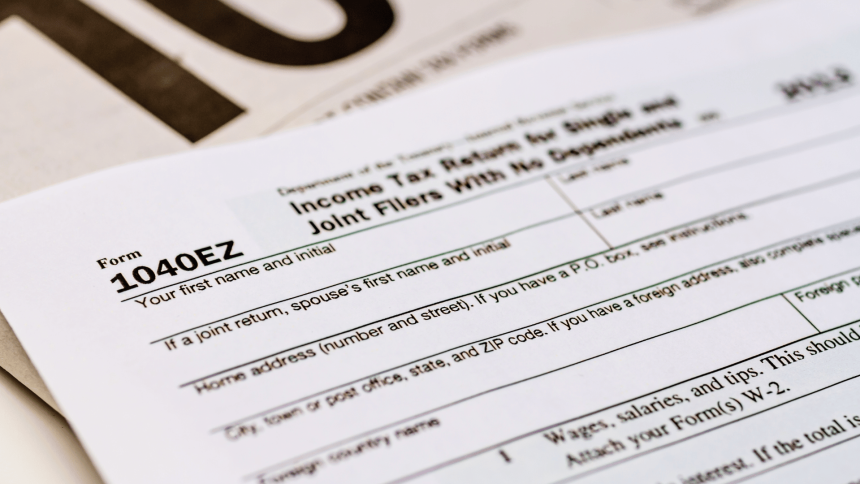

Due to April 15 falling on a Saturday and Emancipation Day, a holiday observed in Washington, D.C., falling on Monday, Tax Day 2023 has been moved to Tuesday, April 18.

The millions of Americans who have not yet filed their taxes will have until Tuesday at 11:59 p.m. PT to do so or at least file an extension, while Mississippians affected by recent storm damage have until July 31.

Jeremy Nelson, a partner with Element Wealth, explained on a recent episode of MidDays with Gerard Gibert how those who haven’t gotten around to filing their taxes this year have an opportunity to save money by reducing tax liability through the funding of an individual retirement account or health savings account.

“You really want to have a good handle on what your overall tax liabilities are going to look like,” Nelson said. “You have up until your tax filing date to fund those retirement vehicles or HSAs to reduce that tax liability.”

If you have already filed a return and it doesn’t contain any errors or red flags, your refund should be delivered within 21 days if you filed electronically and opted to have the money directly deposited into your bank account, according to the IRS.