Last week, the U.S. Senate passed a budget proposal that lays the foundation for tax cuts for middle-class families and job creators.

The Senate voted in favor by a vote of 51-49 and now it will move on to the house.

U.S. Senator Roger Wicker, who voted in favor of the measure, said that reports show that lowering the corporate tax rate could boost average household incomes by $4,000 and that cutting taxes and reforming the tax code could mean overall growth for the economy.

“Passing this budget today was just the first hurdle among many to come,” said Wicker. “With President Trump’s leadership and a committed Republican majority in Congress, I am hopeful we can accomplish this once-in-a-generation achievement.”

Russ Latino, State Director at Americans for Prosperity of Mississippi, echoed the Senator’s opinion that this opportunity to reform taxes is a rare one.

“It really creates a flatter and a fairer and simpler tax system that allows folks to keep more of what they earn while cutting out many of the special interest giveaways that a lot of american’s resent and I think for Mississippians what it means by and large is that if you take out your wallet and look at it, you will have more money in it next year than you do this year in the event that they are able to pass the tax reform proposal,” said Latino.

He added that if the tax reform proposal is passed, Mississippians will see a substantial cut in the amount that they pay to the federal government.

“You’re also going to see a system that is a lot fairer because its not going to be favoring specific industries and specific people who have gone to congressmen because of their connections and been able to get carve outs,” said Latino.

Latino added that the process of doing taxes would be drastically decreased.

“It would be the technological equivalent of doing your taxes on a post card, which for anybody who struggles the week before taxes are due, they know that that is a big deal,” said Latino. “So, overall a great break for individuals and also a great break for job creators.”

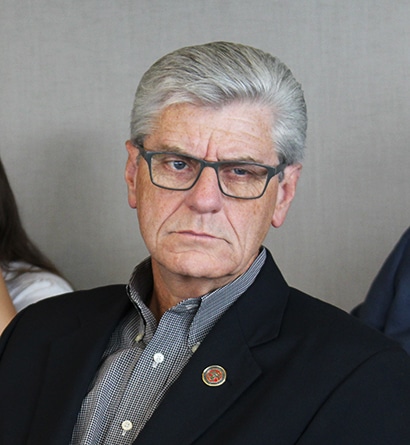

Governor Bryant said that Mississippi’s unemployment rate has reached a record low this year and that in the past five years, Mississippi has added more than 60,000 jobs.

“We have proven here in Mississippi that our economy can thrive when taxes don’t get in the way,” said Governor Bryant. “The national economy should be given that same freedom.”

Latino said that in the new tax proposal, the corporate tax rate would get cut from 35 to 20%.

“A lot of people have this negative view of corporate America, but the reality is that our corporate tax rate in America is the highest in the industrialized world,” said Latino. “The average among most of the first world industrialized nations is about 22% and so cutting it to 20% makes us competitive with the rest of the world and hopefully they will allow businesses that have been looking to re-locate to other places to stay in America and obviously that benefits all the states.”