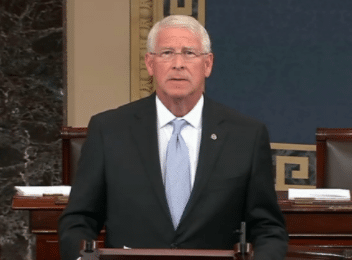

Senator Roger Wicker says that potential tax cuts in America could mean more money for Mississippians.

In a release, Wicker outlined the impact of the proposed Senate tax plan and says that the goal is to create a tax system that benefits Americans and their families.

“This tax reform plan would help American families by expanding the child tax credit to $2,000. It would boost the take-home pay of the middle class, lowering tax rates and doubling the standard deduction for individuals and married couples. It would give U.S. workers a better chance of a pay raise because businesses could invest in their employees and future growth rather than send more money to Washington,” Senator Wicker said. “The goal is to create a tax system that benefits working Americans and their families.”

Senator Wicker went on to describe a study performed by the Tax Foundation which created a state-by-state breakdown of the estimated gain for the average household if the plan is enacted. The average Mississippian would see a gain of $1,800 dollars in take-home income under the new tax plan. Senator Wicker outlined the gain for three different types of income in Mississippi, which can be viewed below.

- For the Single Earner. An unmarried worker making $30,000 a year who does not have any children could see a 1.3 percent increase in his take-home pay under the Republican plan. By taking the standard deduction, his income tax could be cut by 9 percent.

- For the Family of Four. A married couple who earns $85,000 and has two kids would benefit from the expanded child tax credit and standard deduction. The family could see their taxes cut by 20 percent and their take-home pay increase by $2,254.

- For the Retired Couple. Married retirees with $48,000 in income could save under the increased standard deduction for those over the age of 65. Taking into account the tax exemptions on their Social Security, this couple could see a tax reduction of 8 percent.

Senator Wicker said that a debate of the bill is expected “in the coming days.”