Over a month after the Mississippi House of Representatives passed the landmark House Bill 1, or the “Build Up Mississippi Act,” a bill that would gradually phase out the income tax and slash the state’s grocery tax, the Senate has announced a counter tax bill on Wednesday.

The waiting period between the two bills is indicative of what some senators argue is a more measured approach in the construction and expected passage of similar tax reform. While the Senate bill, which is yet to be filed, proposes many of the same tax cut objectives, the chamber led by Republican Lt. Gov. Delbert Hosemann believes it would accomplish them with less of a heavy hand and in a more direct fashion.

The Senate’s tax cut plan would effectively work as a continuation of the tax reform bill signed into law by Republican Gov. Tate Reeves in 2022, a law that eliminated the 4% income tax bracket while phasing down the 5% bracket to 4% by 2026.

The Senate’s proposal would drop that rate to 2.99% by 2030 via annual decrements of .25%, stopping short of total elimination. But the lieutenant governor did point to the Senate aiming to position the state to completely cut the income tax in the future, though the bill proposes an approach that would allow for unknown factors that may unfold beyond the four-year period.

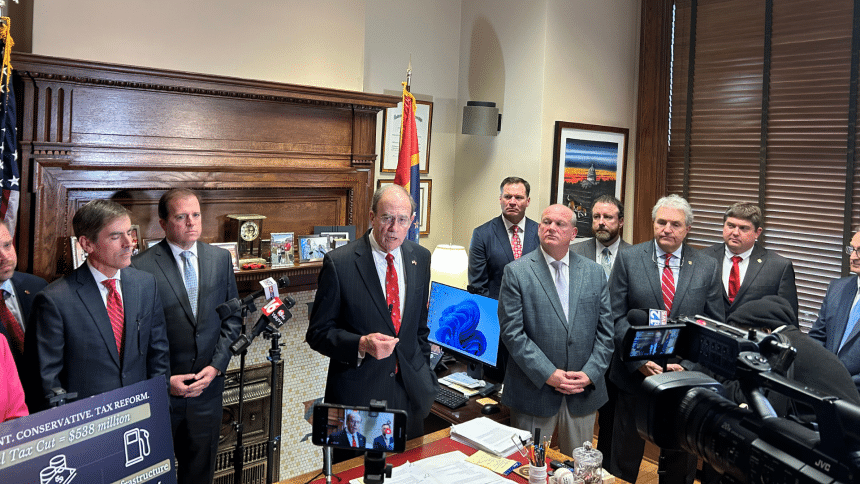

“What we’re talking about is cutting taxes now,” Hosemann said during a press conference at the state capitol, flanked by members who had a hand in forming the bill. “The second thing that’s been really important to us, is that this needs to be a sustainable, conservative approach to tax relief. Just to do things for one year doesn’t mean it’s sustainable.”

While Reeves has publicly hailed HB 1 for completely cutting the income tax, or what he calls the “tax on work,” Hosemann has previously differed in prioritizing a larger cut of the nation’s highest grocery tax instead of income tax eradication. The Senate’s measure proposes exactly that.

The bill would immediately drop the current 7% grocery tax to 5%. The suggested rate cut drops one point lower than the effective rate of 6% the House plan passed in January, a proposed total rate that includes a 4.5% state grocery tax with an attached 1.5% local sales tax designed to make municipalities whole in lieu of a state tax diversion. The Senate bill would leave the general sales tax at 7%.

While the Senate bill would not add the additional 1.5% local sales tax that HB 1 recommends, a separate increased state diversion would keep municipalities at current revenue levels received by the state.

As the tax reform conversation has worn on in recent months, the state’s trio of transportation commissioners have incessantly lobbied for a dedicated recurring stream of revenue for the Mississippi Department of Transportation (MDOT) upon the shuffling of tax revenue.

HB 1 suggests a new 5% sales tax on gas as an MDOT revenue stream, which would stack on top of the current federal excise tax of 18.4 cents per gallon and state gas tax, also 18.4 cents per gallon, that Mississippians pay at the pump. The Senate’s bill would phase in a 9-cent addition over three years, an increase that would formulate both the state gas tax and excise tax concerning inflation, in addition to continuing to fund the current emergency road and bridge fund.

“We need to be measured in how we do that. I think we’ve taken great strides to be careful and cautious in our tax cuts,” Senate Finance Committee Chair Josh Harkins, R-Flowood, said. “It’s responsible, it provides immediate tax cuts to our taxpayers in the state, and it also provides the necessary funding for transportation.”

The Senate proposal also differs from HB 1 in that it would not address funding for the Public Employees Retirement System (PERS), a program currently dealing with an unfunded liability of around $25 billion. But sources inside the capitol said that the Senate is likely to pass separate measures that would funnel revenue to the program in addition to creating a new benefit tier for state employees in Mississippi.

According to Senate leaders, their bill proposes a more conservative tax cut plan primarily to significant revenue gaps that would risk deficits — particularly due to looming expenditure increases.

“Our Medicaid ask will be significantly higher this year,” Senate Appropriations Chair Briggs Hopson, R-Vicksburg, said last month. “And we expect, unfortunately, that it’s going to be significantly higher for many years to come. We will put all that on the table. Not just tax, but other issues that we need to be looking at to be forward thinking in our analysis in putting together a bill.”

The House’s “Build Up Mississippi Act” would more than double the 2022 tax cut signed into law by Reeves which was previously the state’s largest slash ever at more than $500 million. Since the passage of HB 1 on January 16, Reeves has trumpeted praise for the sweeping reform and has hinted, along with other House leaders, that anything less than total elimination of the state income tax would not be considered.

“I think it will end up at elimination, because you’ve got [Gov. Tate Reeves] pushing for it,” Rep. Fred Shanks, R-Brandon, said, noting that the House has been working to eliminate the tax since 2016. ” We’ve been pushing for it since Philip Gunn. It has to be in there.”

According to Hosemann, the Senate’s bill would return approximately $326 million to Mississippi taxpayers in net tax cuts.

If the measure does get the stamp of approval and moves on to the House, the conversation will get longer as the two will need to come together for a collaborative measure to send to the governor’s desk. Although Reeves and staunch proponents of HB 1 are taking an elimination-or-bust approach, Shanks thinks it’s possible the two chambers could still meet somewhere in the middle.

“Is that a dealbreaker? I don’t think so. We’ll be able to work out something,” Shanks said. “We’re definitely getting something done. There is going to be a reduction. I mean it’s going to be a reform at the end of the day, so there’s going to be a lot of factors going in.”