Both chambers of the Mississippi legislature have trumpeted tax reform legislation in the 2025 session. While lawmakers in the Senate and the House are hopeful that a landing spot can be reached to send a bill to Republican Gov. Tate Reeves’ desk, differing approaches are set for a collision course.

While Senate Bill 3095 and House Bill 1 both propose massive tax cuts, the two outline a differing route. HB 1 was whisked through its originating chamber by an overwhelming vote of 88-24 in January and has since been referred to committee in the Senate. Meanwhile, SB 3095 hit the table nearly 40 days later, officially filed by author Sen. Josh Harkins, R-Flowood, on Feb. 19.

The Senate’s tax bill has yet to pass the chamber, but has cleared committee and is expected to be taken up for a full vote before next week’s deadline to do so.

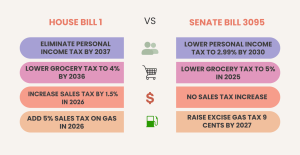

The key differences in the pair of bills are outlined below:

The contradictory approaches are not much of a surprise. In the months leading up to the 2025 session, Reeves publicly voiced his support for the House’s stance, primarily a total cut of income tax, and has continued to do so. Conversely, Republican Lt. Gov. Delbert Hosemann, president of the Senate, said he wanted to prioritize a slash of the grocery tax instead.

This isn’t the first time the two chambers have clashed on tax reform in recent memory. In 2022, then-House Speaker Philip Gunn urged lawmakers in the Senate to join his chamber in passing a bill to eliminate income tax. Hosemann, who was in his third year presiding over the Senate, wouldn’t budge.

But after a late full-court press by Reeves asking lawmakers to at least find a compromise to cut taxes, a bill was eventually sent to his desk and signed to annually phase down income tax until it hits 4% by 2026.

Sen. Jeremy England, R-Vancleave, isn’t concerned about the ideological separation this time around. In fact, he believes his fellow senators want to accomplish the same thing as their compatriots.

“Our position in the Senate is that we can always incrementally walk this down,” England said. “I think that’s a very fiscally responsible way to do this. Nobody in the Senate says we don’t want to go to zero, but let’s see how our revenue works. Let’s see if we can still maintain our core functions of government. But just because this plan doesn’t get to it doesn’t mean we’re not in support of full elimination.”

House members have used Reeves’ staunch support as reason for confidence in HB 1, while also nodding towards the potential for compromise.

Republican House Speaker Jason White, who has helped lead the charge on cutting Mississippi’s personal income tax, calls both measures a “starting point,” echoing England’s sentiment that both chambers largely want the same thing.

“These are good pieces,” White said. “Nobody’s saying the Senate is bad for that being their first stab at a tax cut.”

White also underlined the need to keep municipalities whole if the state does forego a large swath of tax revenue via the cuts.

With both sides generally agreeing that the state’s taxes should be lowered in some fashion, along with the governor’s support, Rep. Fred Shanks, R-Brandon, believes the personal income tax will end up being completely erased.

“I think it will end up at elimination because you’ve got [Gov. Tate Reeves] pushing for it,” Shanks said. “We’ve been pushing for it since Phillip Gunn. It has to be in there.”

But Harkins, who authored SB 3095 and chairs the committee it recently cleared, thinks a more conservative approach makes more fiscal sense for one of the poorest in the nation.

Harkins explained that 41 other U.S. states have an income tax, and those that don’t have it never had it in the first place – aside from Alaska, which can recover lost revenue with oil and gas revenue, and Kansas, which reinstated their income tax after initially repealing it.

“They take a bite of the apple, they digest it, and they make another cut. No other state has done this,” Harkins said. “It’s how you would conduct your business or the finances in your home. You would make sure you have the revenue in your coffers to provide the core services that you’re supposed to provide.”

According to Hosemann, the Senate’s bill would return around $326 million to Mississippi taxpayers in net tax cuts. By comparison, House Bill 1 would axe more than $1 billion in annual taxes.

The deadline for the Senate to pass its package is Feb. 27. In the meantime, lawmakers on both sides will continue to ponder whether it’s elimination-or-bust for Mississippi tax reform legislation in 2025.

“Is [full elimination] a dealbreaker? I don’t think so. We’ll be able to work out something,” Shanks said. “We’re definitely getting something done. There is going to be a reduction. I mean it’s going to be a reform at the end of the day, so there’s going to be a lot of factors going in.”