The Mississippi Senate has officially moved legislation forward that will lower the state’s income tax while simultaneously reducing the nation’s largest sales tax on groceries.

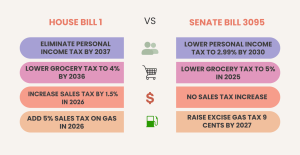

Lawmakers in the chamber voted 31-15 to send Senate Bill 3095 across the state capitol. The legislation, which received some bipartisan support, serves to phase the state’s income tax down to 2.99% by 2030 and cut the grocery tax from 7% to 5% in July 2025 with the intent of providing financial relief for Mississippians. In total, the Senate’s plan would eliminate an estimated $538 million in tax revenue from the state’s general fund, per Republican Lt. Gov. Delbert Hosemann.

But with the decreases comes a hike in another avenue. The bill includes a 9-cent addition to the existing 18.4-cent excise tax on gas, elevating the total fee to 27.4 cents per gallon by July 1, 2027. The goal is to use the funds acquired by the fuel tax increase to fund road and bridge projects statewide.

Now the bill heads to the House of Representatives, which already sent its own tax reform legislation to the Senate. House Bill 1, or the “Build Up Mississippi Act,” passed much earlier in the session as it was Republican Speaker Jason White’s top priority. The legislation would fully eliminate the state income tax by 2037 and phase down the grocery tax to 4% by 2036 and has been publicly lauded by Republican Gov. Tate Reeves.

However, the bill increases the state’s sales tax by 1.5% and ups the gas tax by 5% beginning in 2026. Just like the Senate’s proposal, the House creates a stream of recurring dollars to fund infrastructure improvements across Mississippi. One stark difference between the two pieces of legislation is that the Senate’s version stops after five years of implementation, whereas the House’s plays out over 12 years.

While a majority of senators voted in favor of the legislation, detractors pushed back ahead of the floor vote. Three chamber members took to the podium to try to alter the bill. Sen. Derrick Simmons, D-Greenville, was the first to speak out, challenging the excise tax on gas being upped. He deemed it negligent to impose extra fees at the pump on Mississippians who travel daily for work.

“I think the user fee is the fairest form of payment,” bill author Josh Harkins, R-Flowood, said when questioned about the gas tax increase. “What do you say to the person who drives through our state, stops, and gets gas, but doesn’t buy anything? They’re using our roads, but are they paying for it? Are you relying on your constituents to pay for it through other means?”

Simmons pivoted away from the gas tax and promptly introduced an amendment to fully eliminate the grocery tax rather than dropping it down to 5%. Mississippi is one of just 10 states that taxes groceries, with Mississippi’s 7% rate being the highest in the U.S. Nonetheless, the majority of Senate members voted against Simmons’ amendment.

Sen. David Blount, D-Jackson, offered an amendment to pause the implementation of SB 3095 until the state’s public employees’ retirement system is at least 80% funded. Experts currently estimate that the system has an unfunded liability of approximately $26 billion, sparking concerns over the ability to fulfill obligations to state employees in the long term.

“I think the two most important debates we’ve had so far this session relate to the state’s public employees’ retirement system and this bill…would eliminate a little less than 8% of the state’s general fund budget. What I hear is, ‘The state’s in the best financial shape it’s ever been in and we need to cut the income tax,’ and ‘The retirement system is in a crisis,” Blount added. “Those two things together don’t make a bit of sense.”

Blount, who noted that the retirement system for public employees is only funded at roughly 56%, argued that it is irresponsible for the legislature to kick that can down the road while also reducing a stream of revenue flowing into the state’s coffers. Sen. Daniel Sparks, R-Belmont, disputed Blount’s impassioned remarks and contended that the state can fulfill its obligations to retirees and cut taxes without igniting financial turmoil.

Sparks acknowledged that the Senate has passed bills aimed at shoring up the retirement system with hopes of House colleagues coming to the table to tackle the issue. He also dismissed the notion that it would be reckless to return money to taxpayers without first reaching a certain threshold of money in the pool for retirees’ benefits.

“We control the fact that a lot of Mississippians pay taxes and it’s not our money. It’s their money and this is an opportunity to return that to them,” Sparks said. “We fully intend to pay the benefits earned by employees, retirees, and beneficiaries. To put an arbitrary number in there and say we’re not going to anything on tax, we’re not going to eliminate any tax, we’re not going to reduce any tax would handcuff this chamber and this body, even if it were a good idea.”

Blount’s amendment ultimately failed. Then, Sen. Hob Bryan, D-Amory, a notorious critic of income tax cuts, approached the podium with a scathing rebuke of the legislation. The longtime lawmaker inferred that the bill was short-sighted and would pose immense financial challenges for future legislators. He even questioned the motives of those championing the cause of income tax elimination.

“There is this fixation on abolishing the income tax. I think it speaks volumes that those who wish to completely abolish the income tax are absolutely demanding that we pass it this session — legislation that will not have its full impact until years down the road,” Bryan said. “The last thing they want is something that might allow whoever is sitting in these seats five years from now to look at the situation as it exists then.

“If you’re afraid that somebody five years from now might have a different idea than you do, and you’re afraid that the world five years from now might be different, and you’re trying to make sure the people five years from now will have an uphill battle to try to fix a problem that you created, maybe that’s an indication that your idea is not a good one.”

After lambasting the Senate’s proposal for its gas tax increase as well as other tax hikes in the House’s bill to offset cuts in the income and sales taxes, Bryan offered an amendment to cut the grocery tax in half while doubling the diversions to municipalities to make them whole. The idea also served to send $335 million to the Mississippi Department of Transportation. The proposed amendment did not succeed.

Now that both the House and Senate have passed their respective tax proposals on the floor, the two chambers will have the opportunity to iron out a consensus plan in conference committees with the intention of sending some form of tax cuts to the desk of Reeves.