Following a contentious process that involved contrasting pieces of legislation, fundamental differences by top leaders in both chambers of the Mississippi legislature, and an errant decimal point that was promptly taken advantage of, Republican Gov. Tate Reeves officially signed a bill on Thursday to eliminate the state’s income tax, lower the grocery tax, and provide recurring funding for infrastructure projects.

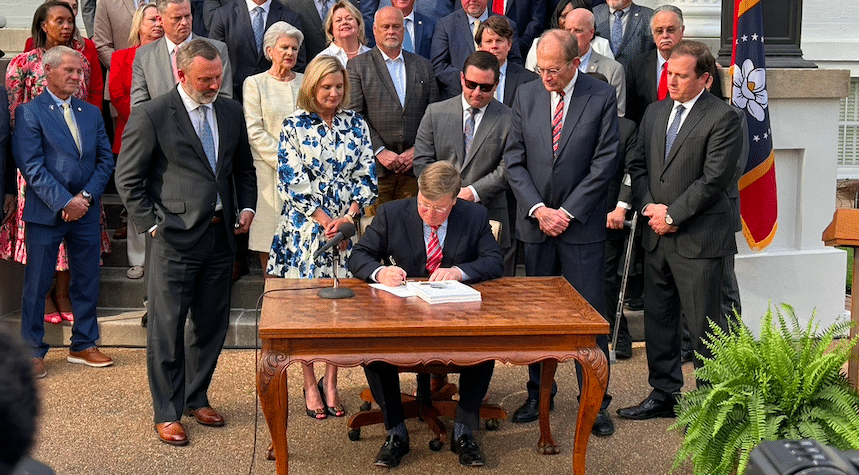

A bevy of lawmakers gathered at the Governor’s Mansion in downtown Jackson to watch Reeves sign House Bill 1 into law. The legislation, authored by Rep. Trey Lamar, R-Senatobia, serves to reduce the personal income tax from 4% to 3% by 2030 with plans for full elimination by 2037 , drop the sales tax on groceries from 7% to 5% this summer, add a fifth benefits tier to the state’s public employees’ retirement system, and create a stream of annual dollars flowing into capacity projects.

Reeves, who made it clear when seeking a second term in office that his top priority was to eliminate the state income tax, was able to fulfill that plan by inking his signature on an official piece of legislation that does just that — but over time.

“This is more than a policy victory. This is a transformation. And it’s a transformation that I have believed in, fought for, and worked toward for many years,” Reeves said.

“From my days as lieutenant governor to my first campaign for this office – and every legislative session since – I have made this my mission because I believe in a simple idea: that government should take less so that you can keep more, that our people should be rewarded for hard work, not punished, and that Mississippi has the potential to be a magnet for opportunity, for investment, for talent, and for families looking to build a better life.”

Though the bill made it to the finish line, the process featured drama, infighting between legislative leaders on social media, and an opportunistic capitalizing of a typo that would ultimately minimize guard rails to prevent tax cuts.

After sending a countering tax reform bill to the other side of the capitol, the Senate gutted HB 1 and inserted much of the language of its tax bill into the legislation on the day of a deadline to address appropriation bills in the other chamber. Well, attention to detail was missed, and instead of both chambers sending members to conference to iron out a bill together, the House concurred with the Senate’s edits — largely due to a major typo that would expedite the process of total income tax abolishment.

Unlike the spirit of the House’s proposal, which was gradual elimination with no strings attached, the Senate, led by Finance Committee Chair Josh Harkins, felt it was prudent to put “triggers” in place to avoid economic calamity in the future. The Senate’s intent was to ensure that, after 2030, revenue growth over spending must reach 85% for a further drop in the income tax. Well, the amended version of HB 1 reads “.85%,” meaning economic elevation will not have to be grand for taxes to drop.

Republican House Speaker Jason White and other chamber leaders aware of the error elected not to go across the capitol hall to give the Senate an opportunity to remedy the miscue and pounced, deciding to send the bill to Reeves, who was eager to enact it into law. Nonetheless, Lt. Gov. Delbert Hosemann, the Senate’s presiding officer, was in good spirits on Thursday and celebrated the new law’s passage.

“Today is a historic day in Mississippi, and one that’s going to bring positive and lasting change. Some may have doubted — and sometimes maybe even ourselves — whether or not we could have one big, beautiful bill … Some of y’all are focused on a typo in the bill, and I use the biblical analogy, ‘Let he who has not had a typo cast the first stone,'” Hosemann said “It continues to be the intent of the Mississippi legislature and the Senate to reduce and eliminate the income tax as we look at our state’s revenue when we go forward with this.”

In addition to the tax cuts, a 9-cent increase to the excise tax on gas will be phased in over a three-year span. 74% of revenue accrued is set to go to the Mississippi Department of Transportation, 23.25% to the State Aid Road Construction Fund, and 2.75% to the Strategic Multi-Modal Investments Fund for infrastructure upgrades.

New state employees will be moved to a Tier 5 retirement plan under the public employees’ retirement system. This will apply to those who take state jobs after March 1, 2026. A measure approved by the PERS Board of Trustees in 2024, Tier 5 will reform the benefit structure for future state workers to rectify concerns about the financial viability of the program.

Not all lawmakers are on board with the concept of income tax elimination, though. Specifically, Sens. Hob Bryan and David Blount, both Democrats, recently gave impassioned speeches on the Senate floor outlining how they believe wiping out a large sum of revenue from entering the state’s general fund will yield harsh ramifications on Mississippi’s economy.

In response to those allegations, Lamar contended that it is prudent for the state to capitalize on recent financial momentum, including several years without a budget deficit, by returning funds to the people who fund the government’s operations. He is also optimistic that continued economic development will make up for any losses through tax cuts.

“I’m more concerned about the pocketbooks of working Mississippians taking care of their families than I am about the state budget. The state budget will survive. The state budget will be fine. Right now, we’re running historic surpluses,” Lamar said. “We feel very strongly about the state economy. We know there are multiple economic development projects coming down the pipe. We’ve seen record investments and capital investments, and jobs all over the state. We just believe this is the best move. It’s bold, transformational, and historic. Mississippi has been in last place for a lot of years, so let’s do something big.”

Thursday, March 27, 2025, marks a moment in state history when a landmark bill took a roundabout path to its destination and reached the finish line. Mississippians will see relief at the grocery store on July 1 and alleviation on state income taxes in 2027.