On January 16, the Mississippi House of Representatives passed a sweeping tax reform bill. House Bill 1, the “Build Up Mississippi Act,” includes numerous adjustments to the overall tax structure in our state, including phasing out the individual income tax.

Below is a run-down of what exactly HB1 would do and an analysis of its key provisions.

Phase out the individual income tax

In 2022, a measure was enacted that reduces the individual income tax incrementally: eliminating the 4% bracket in 2023, trimming the 5% bracket to 4.7% in 2024, 4.4% in 2025, and 4% in 2026. HB1 would further cut the rate to 3% in 2027, then decrease the rate through a series of annual decrements of .3% from 2028 until 2037 to a terminal individual income tax rate of 0%.

End the sales tax diversion to cities

To counter the loss of income tax revenue, the current diversion of 18.5% of general sales taxes to municipalities would end and be retained by the state. This would apply only to those commodities currently taxed at the full 7%. The diversion to municipalities would still be maintained for goods and services currently taxed at a lower sales tax rate, e.g., vehicles.

Increase the sales tax rate on non-grocery items; reduce the rate on groceries

To replace the current sales tax diversion to municipalities, a local sales tax of 1.5% would be added to the present general 7% sales tax rate for a total of 8.5% on non-grocery items.

Total sales tax on groceries would be reduced to 6%, including the new 1.5% local component in the second half of 2026 (Fiscal Year 2027). The rate would decline in .2% increments over 10 years, beginning in FY 2027, permanently setting the sales tax on groceries at 4% (2.5% state and 1.5% local) in 2036. Only non-prepared food products would qualify for the lower rate, consistent with grocery items that are eligible for the SNAP program, commonly known as “food stamps.” The 1.5% local tax would not apply to goods and services currently taxed at a lower rate, again, e.g., vehicles. Local governments could opt out, but no referendum would be required.

Implement a new 5% sales tax on fuel purchases

A dedicated source of revenue to the Mississippi Department of Transportation for roads and bridges would be derived from a new 5% sales tax on fuel purchases. This tax is in addition to the current 18.4 cents per gallon excise tax applied to fuel sales in Mississippi.

Change the allocation of net proceeds generated by the Mississippi Lottery

Presently, the first $80 million of annual net proceeds produced by the Mississippi Lottery Corporation (MLC) are transferred to the State Highway Fund. Annual net proceeds in excess of $80 million are transferred to the Education Enhancement Fund (EEF).

Under HB1, the first $100 million produced in a year would go to the Public Employees’ Retirement System (PERS), which is grappling with a $25 billion unfunded liability. The remainder would be split equally between the EEF and the Multi-Modal Transportation Improvement Fund. The average annual net proceeds produced by the MLC is $126 million since games were launched in November 2019.

Implementation schedule

| Key Provision | Effective Date |

| Increase the Sales Tax on Non-Grocery items by 1.5% | July 1, 2026 |

| Reduce the Sales Tax on Groceries to 6% (4.5% state + 1.5% local) | July 1, 2026 |

| Implement a 5% sales tax on fuel | July 1, 2026 |

| Reduce the Sales Tax on Groceries to 4% (2.5% + 1.5% local) | July 1, 2027, through June 30, 2036, in .2% annual increments |

| Reduce the Income Tax to 3% | January 1, 2027 |

| Fully Eliminate the Income Tax | January 1, 2027, through December 31, 2036, in .3% annual increments |

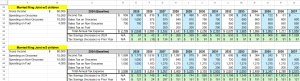

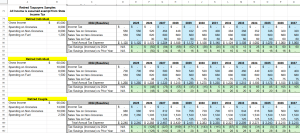

Charts: Mississippi’s general fund revenue and spending

Analyzing the income tax provisions of HB1

You’ll be receiving tax documents through the end of January. Those apply to tax year 2024, where all taxable income greater than $10,000 is taxed at 4.7%.

For tax year 2025, the rate contracts to 4.4%, then reduced to 4% in 2026, pursuant to House Bill 531 enacted in 2022. Compared to 2024, that’s a 6.4% decrease in 2025 and a 14.9% decrease in 2026. Again, these rate decreases are based on existing law.

As previously discussed, should HB1 become law, the income tax rate would be reduced to 3% for calendar year 2027, then completely phased out by 2036. Thus, the income tax rate for calendar year 2037 and all years thereafter would be 0%.

Enacting HB1 would reduce your taxes by 36% through 2027, relative to 2024 (assuming your income remains constant). The remaining 64% of your state income taxes would be reduced incrementally to zero in 2036.

In my view, the 2025 measure is really a continuation of the 2022 law – which I described at the time as a “down payment” on full tax elimination. And here we are.

Since HB1 was introduced, reaction from Mississippi taxpayers has been mixed.

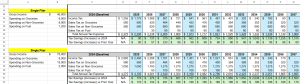

How will HB1 affect various taxpayer scenarios?

The images below break down how HB1 would affect various taxpayer scenarios. The full tax example can be viewed here.

Low income and low income with SNAP benefits.

Single filers

Married filing joint (with two children)

Retired taxpayers

Common concerns expressed about HB1

HB1 is a “tax swap”

Many have criticized the legislation as a “tax swap” since in addition to the bill’s key objective of eliminating the income tax and reducing the sales tax on groceries, HB1 also increases local sales taxes on non-groceries by 1.5% and creates a new 5% sales tax on fuel.

The word “swap” is commonly defined as giving one thing and receiving something else in exchange. Under HB1, working Mississippians would pay a little more for non-groceries and gas in exchange for paying no tax on their wages and lower sales taxes on groceries. While every household’s budget varies in terms of taxable income and spending, most Mississippi workers will benefit from HB1.

HB1 would have a minimal impact on retired Mississippians, who pay no state income taxes on their retirement income. Retirees would pay a little more for non-groceries and gas while enjoying lower sales taxes on groceries. The average retiree would see minimal change in their overall state tax expense.

Why is HB1 raising sales tax on non-groceries?

Mississippi relies on two major sources of general fund revenue – sales taxes and personal income taxes. For the fiscal year ending June 30, 2025, sales taxes are projected at $2.9 billion or 38% of total general fund revenues, and individual income taxes are estimated at $2.1 billion or 28% of general fund revenues.

For Fiscal Year 2025, total general fund revenues are estimated at $7.6 billion, while total general fund appropriations are $7 billion, producing a surplus of $600 million. While many states appropriate nearly all or 100% of revenues collected, and others have been grappling with deficits, Mississippi lawmakers have spent less than funds collected for the past several years. That practice has allowed the state to build up significant reserves and has positioned the state to reduce the tax burden on citizens.

Under present law, most goods and services in Mississippi are subject to a 7% state sales tax. A diversion of 18.5% of sales taxes collected by the Department of Revenue is transferred to the municipality in which the sale subject to sales tax occurred. This is a major source of revenue used by cities and towns to provide citizen services such as public works, law enforcement, water service, streets and bridges, etc. Eliminating the diversion of sales taxes collected by Mississippi for its general fund necessitates the need to add a new layer of sales taxes to replace lost revenue at the municipal level. Conversely, ending the diversion, and thus, allowing the state to retain those monies, offsets (but not fully) the loss of revenue from eliminating the income tax and reduction of the sales taxes on groceries.

Why is the elimination of income tax and reduction of grocery tax not immediate?

Elimination of the individual tax is expected to drive economic growth in the Magnolia State. With economic growth, comes steady increases in state revenues. Phasing in the elimination of the income tax and cuts to the sales tax on groceries enhances the manageability of the general fund budget as these adjustments are integrated into the state’s revenue picture.

Unlike the federal government, which produces $2 trillion or 30% annual deficits, the state must balance its budget and doesn’t have the luxury of owning a dollar-printing machine (The Federal Reserve). Thus, it would be irresponsible and impractical to strip the state of such a large tranche of revenue.

Why Does HB1 create a new 5% sales tax on fuel?

The Mississippi Department of Transportation’s annual budget is approximately $1.4 billion, with nearly 80% derived from federal funds and state excise taxes on fuel. Mississippi’s excise tax is 18.4 cents per gallon.

MDOT Executive Director Brad White and the agency’s three district commissioners maintain that Mississippi could access additional federal highway funds if more state monies were available to pair.

HB1’s architects hold that most Mississippians’ overall tax burden will be reduced even with the new fuel tax while increasing funds available to MDOT for new road and bridge capacity and maintenance projects.

Why does HB 1 change the way lottery proceeds are allocated?

The Public Employees’ Retirement System is dealing with an unfunded liability of roughly $25 billion. Actuaries have recommended increasing the employer contribution rate and infusing cash into the PERS fund. House lawmakers see the redirection of Mississippi Lottery Corporation proceeds as a partial solution to PERS’ financial plight. For more information, see “Analysis: PERS is the elephant in the room”, an article published in November 2023, where I analyze financial headwinds facing the Mississippi PERS system.

Can’t the state cut spending to pay for income tax elimination without raising other taxes?

Taxpayers naturally expect the State Legislature to serve as good financial stewards of taxpayer money. Thus, lawmakers should constantly identify areas to cut unnecessary spending. More importantly, those we elect to state office should pass laws and promulgate policies that optimize the use of public money.

There is no doubt that opportunities exist to trim the state’s budget. Eliminating one-third of general fund revenues (individual income taxes) would require significant cuts in general fund spending – some $2.2 billion annually or 31% of outlays.

The state auditor recently paid $2 million to a prominent Massachusetts-based consulting firm to identify wasteful spending in state agencies. The contract stipulated that the firm find at least $250 million in potential savings. Their final report uncovered $335 million in unnecessary spending, or 4.7% of total general fund outlays.

So, you can see the math problem here. Even if every penny found by Boston Consulting Group were to be cut from the budget, which is highly unlikely, agencies would have to cut an additional $1.8 billion to offset the elimination of the income tax.

How will HB1 affect property taxes?

Property taxes are collected by each Mississippi county’s tax collector to fund public schools (combined with the state’s per-student appropriation) plus county and municipal services. Property tax revenues do not fund state general fund spending. Thus, the elimination of the state income tax, as contemplated in HB1, is not contingent on any adjustment to local property taxes.

The current diversion – to municipalities only – of 18.5% yields 1.296% of total retail sales that occur within an incorporated town or city. Under HB1, municipalities will retain 100% of the new 1.5% local option. That represents a .2% increase in municipal sales tax revenue. Additionally, counties will also participate in the new 1.5% option imposed on retail sales that occur in a county, but outside of municipalities within the county. HB1 requires that money be dedicated to county roads.

In summary, this legislation has no bearing on property taxes or their use.

How does Mississippi’s tax structure compare to our neighbors?

One of the challenges to cutting taxes in Mississippi is that our tax burden is already low, thanks to conservative leadership. In 2022, a tax reform bill was enacted that eliminated the 4% bracket in 2023, leaving only one – 5% – on taxable income that exceeds $10,000. The measure further reduces the flat rate of 5% incrementally over three years, settling at 4% in 2026.

The following chart shows a contrast of the key tax rates among the states that border Mississippi.

| State | Top Individual

Income Tax Rate |

Non-Groceries Sales Tax Rate | Groceries

Sales Tax Rate |

Property Tax Rate (Avg) | Gas Excise Tax Per Gallon |

| MS | 4.0% | 7.00% | 7.00% | .67% | 18.40¢ |

| LA | 3.0% | 9.56% | 4.56% | .56% | 20.93¢ |

| AL | 5.0% | 9.29% | 8.29% | .40% | 29.00¢ |

| AR | 3.9% | 9.45% | 3.52% | .64% | 24.70¢ |

| TN | 0.0% | 9.55% | 5.20% | .58% | 27.40¢ |

Notes:

- The income tax rate listed is the top rate only. Mississippi’s standard deduction and personal exemptions are more generous than the other states. Additionally, the first $10,000 of taxable income in Mississippi is not taxed.

- Mississippi’s non-groceries sales tax rate is the lowest of the five states listed in the chart. That’s because virtually every county/parish and municipality in the border states tack on local taxes to state sales taxes.

- Mississippi’s excise tax on fuel is the 49th lowest in the nation. Even after adding a 5% sales tax on fuel, as proposed in HB1, the state’s blended tax on fuel would remain comparatively low.

What are the risks associated with eliminating the income tax?

There are two major risks in eliminating the individual income tax.

First, the state would be primarily reliant on sales taxes to cover general fund functions – education, Medicaid, corrections, etc. To replace existing income tax revenue, retail sales would need to increase by approximately $15 billion (in today’s dollars), annually, or roughly 25% – net of eliminating the present sales tax diversion to municipalities. What is more likely is an influx of new residents driven by economic growth and new job opportunities stemming from eliminating the income tax. Retail purchases by new Mississippians will bolster sales tax revenues. These dynamics validate that the incremental approach to phasing out the income tax, as provisioned in HB1, is a good strategy.

Second, one word: Medicaid. After education, Medicaid is the second largest general fund spending category. The public health program, which provides coverage for certain low-income individuals and families, is jointly funded by federal and state dollars. Mississippi has the highest federal match (FMAP) in the nation at 76.90% of total Medicaid expenditures.

The federal government contributes nearly $6.5 billion to Mississippi’s nearly $1 billion share for a total program cost of over $7 billion – and that’s without enacting Medicaid expansion. The total cost to operate the Medicaid program in Mississippi is larger than the entire state general fund budget.

Healthcare costs are rising rapidly and disenrollment after the Public Health Emergency for COVID-19 expired in May 2023 has been challenging. It would not surprise me to see Mississippi’s Division of Medicaid (DOM) request a sharp budget increase for Fiscal Year 2026 and beyond.

More importantly, Republican President Donald Trump’s administration and the newly minted Department of Government Efficiency (DOGE) have the Medicaid program in the crosshairs for cost-cutting. Total annual federal spending on Medicaid is over $620 billion, or 9% of total outlays. Several options are being discussed that could trim federal Medicaid spending, such as reducing the FMAP and converting to a block grant model. Either could mean the loss of significant federal dollars to Mississippi.

Additionally, proposals are circulating around ending the enhanced FMAP for the Medicaid expansion coverage group, making the program more expensive for states to operate. Mississippi lawmakers should give Medicaid expansion no serious consideration without clarity about the fate of the program from Washington.

What’s likely to happen?

Neither Lt. Gov. Delbert Hosemann nor the Mississippi Senate has provided any feedback on HB1. Rather, the Senate has indicated plans to release their own version of tax reform legislation. How will that differ from the House bill?

The Senate’s version will likely incorporate the following provisions:

- Implement a deeper cut to the grocery sales tax and phase in the cut in a shorter timeframe.

- Impose a smaller or no additional sales tax on non-groceries

- Increase the excise tax on fuel by a few cents as opposed to the 5% sales tax proposed in HB1.

- Offer a plan to phase down the state income tax, consistent with the House’s approach, but stop short of full repeal. Perhaps the Senate’s bill reduces the rate in half to 2%.

Any final bill that makes it to Gov. Tate Reeves’ desk will likely be a blend of the House and Senate versions.

I have long supported eliminating the state’s income tax. I believe that the elimination of the tax on work and productivity would spur economic growth, create jobs, boost wages, attract new residents, and aid in retaining the talented graduates of our world-class colleges and universities.

However, abolishing a key state revenue stream must be done prudently, thoughtfully, and methodically. The governor rightfully promotes that “This is Mississippi’s time.” If the House and the governor have their way, 2025 will be Mississippi’s time to join the nine other states with no income tax.

The views expressed by contributors are their own and not the views of SuperTalk Mississippi Media.