The 2019 tax season represented a milestone in Entergy Mississippi’s efforts to help low-income customers break the cycle of poverty.

Ten years ago, Entergy began sponsoring free Super Tax Day events throughout its four-state service area to help qualifying customers claim the Earned Income Tax Credit. Since 2009, Entergy’s signature poverty-elimination program has helped some 30,000 working families in Mississippi claim over $64.6 million in EITC refunds.

“At Entergy, our vision ‘We Power Life’ means working together to improve lives, create opportunities, strengthen communities and proactively find solutions for customers facing economic challenges,” said Leo Denault, Entergy chairman and CEO. “By supporting Super Tax Day, Entergy and our partners not only extend a helping hand to working families but also invest in a brighter future for our communities.”

The federal EITC program is one of the nation’s more effective tools for lifting low-income workers and their families above the poverty line. The Internal Revenue Service reported that the EITC and Child Tax Credit together lift more than nine million people out of poverty each year, including five million children. That’s more than any other federal program except Social Security.

Over the last decade, Entergy has helped almost 150,000 working families claim $258 million in EITC refunds. Entergy and its Super Tax Day partners have tracked many success stories that prove the program’s impact. With free tax help and EITC refunds, many customers have become first-time homeowners, established savings accounts, repaired credit, pursued education and reached other goals that help build generational wealth and financial stability.

“The work Entergy has done with our Super Tax Day partners has been life-changing for our customers and our communities,” said Haley Fisackerly, Entergy Mississippi president and CEO. “Through the years, we’ve expanded our partnership networks to serve more customers at more Voluntary Income Tax Assistance sites. We continue to see the positive difference it makes for families in Mississippi who qualify for the EITC program.”

Entergy began supporting Super Tax Day events years earlier, it launched the first Super Tax Day campaign throughout its service area in 2011. That year, 9,600 customers received some $13 million in EITC refunds. Within two years, the number of returns and refund amounts almost doubled as Entergy grew its Super Tax Day efforts and partnership networks. Growth has been steady ever since. Today, total annual refunds exceed $30 million and total returns top 18,000 across the corporation’s four-state service area. Entergy sponsors some 300 VITA sites where customers can get free tax prep services. In 2019, Super Tax Day events in Mississippi helped generate $8.5 million in EITC refunds for over 4,000 customers.

Entergy also worked with partners to expand the services available on Super Tax Day. These include financial coaching, budget workshops, free legal services, drop-off tax prep services and more. Participating banks have helped customers open savings accounts onsite at some of the VITA locations. Additionally, incentives such as scratch-off cards with cash prizes have been effective in encouraging customers to save part of their refunds.

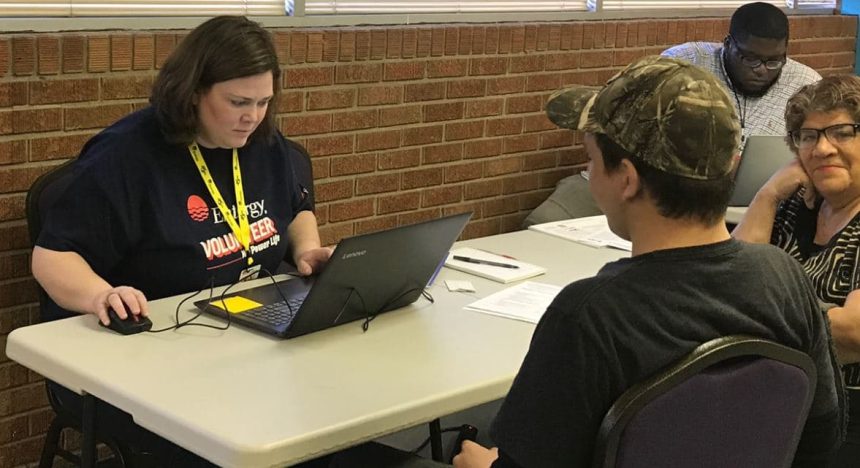

Entergy employees have been a driving force in the growth of Super Tax Day. Entergy offers IRS-certified training for volunteers who staff VITA sites throughout tax season and during annual Super Tax Day events. This year, 124 Entergy employees logged almost 3,500 volunteer hours helping customers file taxes and claim the EITC.

“Our efforts wouldn’t be possible without the participation and enthusiasm of employees,” said Fisackerly. “They volunteer as certified tax preparers and serve in a variety of support roles. The preparation and teamwork that goes into our Super Tax Day events is amazing and a testament to their leadership in our communities.”

To find out more about Super Tax Day, locate nearby VITA sites and learn about qualifications and documents needed, visit entergy.com/freetaxhelp.