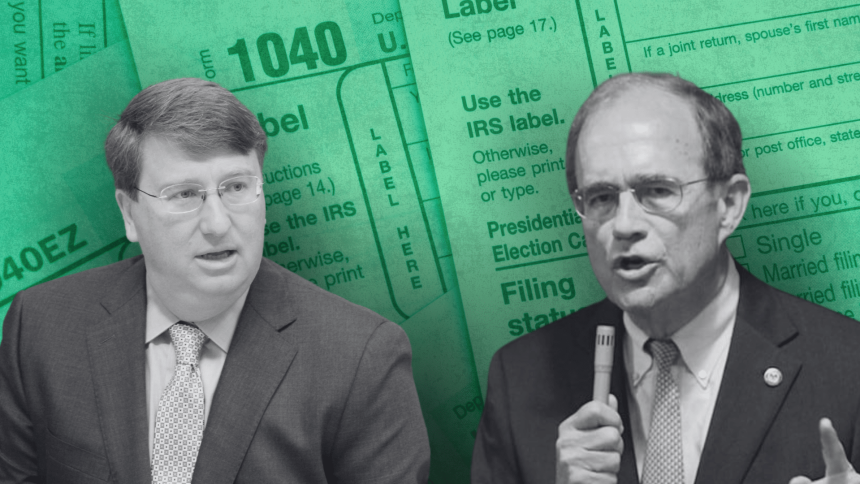

Mississippi’s highest-elected state officials may have opposing tax agendas going into the 2025 legislative session.

While Gov. Tate Reeves has maintained that chief among the top priorities of his second term is to completely eliminate Mississippi’s income tax, or what he calls a “tax on work,” Lt. Gov. Delbert Hosemann could possibly throw a wrench in those plans by pivoting the legislature’s focus to slashing the state’s grocery tax, which is the highest in the U.S.

“I think the grocery tax is out of whack. To me, I think inflation, groceries, prepared foods, and whatnot have skyrocketed,” Hosemann said on MidDays With Gerard Gibert. “We’re currently reducing the income tax again this year and next year. We’re getting rid of the inventory tax. I think it’s time to look at the grocery tax.”

Reeves signed the largest-ever tax cut in Mississippi history into law in 2022. The legislation eliminated the state’s 4% tax bracket and will gradually phase the 5% bracket down to 4% by 2026, though some lawmakers and the governor alike have called for the process of total income tax elimination to be expedited.

Nonetheless, the lieutenant governor argued that slashing the state’s burdensome 7% grocery tax would be more beneficial for residents and feasible for the state. Hosemann projects that each percentage of the grocery tax that is cut would cost the state around $62 million compared to more than one-fourth of Mississippi’s revenue stream disappearing as a result of the income tax being gutted.

The Senate leader also assured that municipalities, many of which depend on the grocery tax as a primary revenue source, would be compensated by the state for any losses incurred. He further contended that it makes more sense to start the process of lowering the grocery tax while other forms of taxation are already being phased out instead of increasing taxes on consumption to justify eliminating a chunk of cash flowing into the state’s coffers.

“I’m not seeing a lot of push right there on accelerating [a total income tax cut] at this point,” Hosemann continued. “It’s $2 billion. It’s 28% of our budget, so you can’t just say, ‘Well, we’re going to eliminate it tomorrow,’ unless you’re going to do it like they tried the last time, which was to raise the sales tax 2.5%.

“I think the way we’ve done it, which is a gradual reduction while not raising anybody’s taxes, has been proven to be a pretty smart way to do business.”

While Hosemann, who has called for taxpayers to be reimbursed via a one-time rebate in the past, is not opposed to looking at ways to expedite income tax elimination in the future, he made it clear that the grocery tax will take precedence come January.

House Speaker Jason White has also voiced his support for lowering the grocery tax — even calling for it to be shrunk in half as soon as possible. He is simultaneously an ardent supporter of eradicating the income tax but doing so over a period of time that would allow lawmakers to adjust to any possible ramifications.

Reeves’ office had not responded to a request for comment at the time this story was published.