After months of debates, and even infighting among leaders in the Mississippi House of Representatives and Senate, a bill to phase out the income tax is on pace to head to the desk of Republican Gov. Tate Reeves.

In a 92-27 vote on Thursday, the House overwhelmingly supported an amended version of HB 1, or the “Build Up Mississippi Act.” The move comes days after the Senate Finance Committee amended the legislation and passed it on a 32-16 floor vote. Both chambers moved forward with the proposal, despite impassioned speeches by a handful of dissenting Democratic lawmakers.

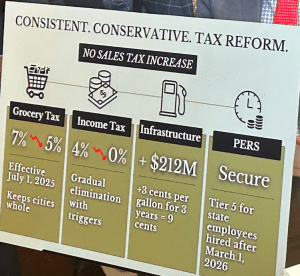

A more cautious approach than no-strings-attached elimination, the bill serves to reduce the income tax from 4% to 3% between 2027-2030 with plans for future cuts down to elimination contingent on economic growth. For example, if Mississippi has a rough year financially after 2030, guardrails are in place to prevent a tax decrease that year.

The triggers were established to prevent Mississippi from ending up like Kansas, which enacted a large income tax cut in 2012 with no triggers and had to repeal those cuts five years later due to disastrous economic outcomes.

“What this bill essentially does is that it lets the economy dictate and warrant the necessity to cut taxes,” Senate Finance Chair Josh Harkins, R-Flowood, said. “These triggers will guide us. It depends on how the economy is going. If it’s roaring, we’ll be making big cuts. If it’s not going as some would expect or like, then there may be smaller cuts. But there will be cuts nonetheless.”

As was part of the Senate’s original plan to cut taxes, Mississippi’s nation-leading sales tax on groceries would drop from 7% to 5% in July 2025 to give consumers relief at the checkout line. There will also be no increase in the sales tax, something the House proposed throughout the session.

A 9-cent increase to the excise tax on gas would be phased in over a three-year span. 74% of revenue accrued would go to the Mississippi Department of Transportation, 23.25% to the State Aid Road Construction Fund, and 2.75% to the Strategic Multi-Modal Investments Fund for infrastructure upgrades.

Both chambers also agreed to move new state employees to a Tier 5 retirement plan under the public employees’ retirement system. This would apply to those who take state jobs after March 1, 2026. A measure approved by the PERS Board of Trustees in 2024, Tier 5 would reform the benefit structure for future state workers to rectify concerns about the financial viability of the program.

Though a social media scuffle between Republican House Speaker Jason White and Republican Lt. Gov. Delbert Hosemann late last week appeared to put tax reform negotiations in peril, both sides of the GOP-led legislature ultimately came together to pass what is argued to be a transformative piece of legislation.

Gov. Reeves, who’s made it clear that his top priority in his second term is to eliminate the “tax on work,” is likely to sign the bill into law when received from lawmakers.