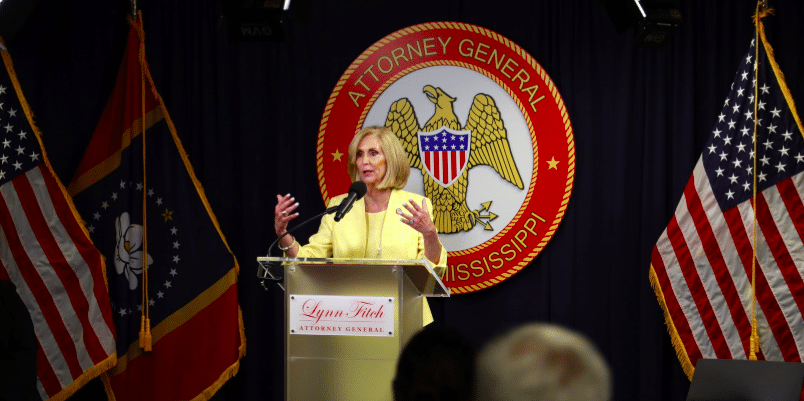

Mississippi Attorney General Lynn Fitch has joined 38 of her colleagues in urging Congress to pass legislation that would outlaw pharmacy benefit managers from owning or operating pharmacies.

A sentiment against pharmacy benefit managers (PBMs), or third-party liaisons between pharmacies, insurance companies, and drug companies, has been growing in recent years, specifically among small pharmacy owners and consumers. With PBMs having direct influence on the drug-pricing market, the legal leaders believe it would be inappropriate and unethical for them to own pharmacies.

“PBMs exert outsized influence in the healthcare marketplace, raising prices for consumers and forcing independent pharmacies out of business, which only aggravates access to healthcare, particularly in rural areas,” Fitch said. “Allowing PBMs to own and operate pharmacies gives them more power to manipulate drug prices for medication that many Mississippians rely on for survival. States have been fighting back, but we need Congress to take action, too, and protect consumers from PBM exploitation.”

The attorneys general allege that horizontal consolidation and vertical integration have transformed PBMs from useful administrative service providers into market-dominating behemoths that control the industry. All of the top six PBMs operate their own affiliated pharmacies, while five of the top six are also a part of parent conglomerates that operate insurance companies and health care clinics.

A prime example of this is CVS Caremark, a PBM, owning and operating CVS pharmacy outlets in all 50 states. Other examples can be found below:

PBMs, through ownership of affiliated pharmacies, are contracting with and have power over their own pharmacies’ competition, per attorneys general. The PBMs are accused of using their position as middlemen to exert this power in ways that harm independent pharmacies, forcing these small businesses to accept contractual terms that are confusing, unfair, arbitrary, and harmful.

Small pharmacy owners and advocates have decried these alleged actions by PBMs and fear that independent pharmacies could go out of business if action is not taken. A letter addressed to Congress by the attorney generals urges action to protect consumers and small businesses by enacting a law prohibiting PBMs or their parent companies from owning a pharmacy.

Earlier this year, the Mississippi lawmakers allowed a bill to die in conference intended to impose stricter regulations on PBMs by prohibiting spread pricing. Spread pricing refers to when a PBM charges a higher price for a drug to an insurance company than the amount it pays to the pharmacy. This allows the PBM to reap a profit at the expense of the pharmacy. The legislation also served to prohibit PBMs from directing patients to associated pharmacies.