The U.S. House is set to vote on proposed tax reform this morning.

Here’s what we already know about the new tax plan.

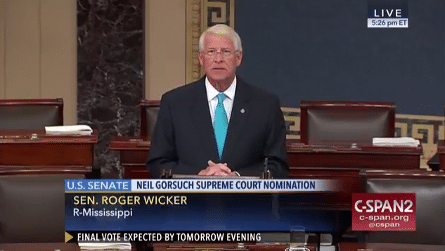

“We know what the general framework is going to be and that is we are are going to double the standard deduction for average Americans so a lot of people won’t have to go through the trouble of itemizing,” said U.S. Senator Roger Wicker. “We are going to cut rates for individual taxpayers, we are going to increase the child credit, and we’re going to make our small businesses and job creators more competitive with those tax rates that our friends overseas are charging to job creators and small businesses.”

RELATED: State Leaders speak out on U.S. tax reform

However, there has been some concern that the new tax cuts could be detrimental to some in the real estate business.

“The complaint that we are seeing from some of our friends in the home building business and real estate business, is that a lot of people won’t need to use that deduction because we are going to double the standard deduction,” said Wicker. Now to me, if you make it easier for individuals to file their taxes, I don’t care whether they have to itemize or whether it’s just an easy double standard deduction. To me, that’s not a game changer. On the saving issues, I don’t know what the final product will have, but I can assure you we are going to vote for a bill that encourages savings and it doesn’t do anything to destroy these programs that work really well.”