A pair of Mississippi men and one business have been prohibited from selling tax services.

Thomas Walt Dallas, Jason Todd Mardis, and Flowood-based Capital Preservation Services are reported to have marketed a tax scheme at numerous professional conferences and media appearances targeting medical professionals and small business owners.

According to the Department of Justice, they allegedly, falsely claimed that customers following their tax plans could claim multiple deductions to which they were not actually entitled. The false claims included:

- The customers’ businesses could take deductions for paying large, unnecessary “marketing fees” to newly created, sham marketing companies.

- The marketing companies could employ family members, including minor children, and take deductions for family meals, vehicle expenses, and tuition, among other items.

- The customers could “rent” their homes to their businesses on a short-term basis at exorbitant rates and avoid paying taxes on the rental income.

The complaint further alleges that Dallas, Mardis, and Capital Preservation Services knew or had reason to know that their statements to customers about the supposed tax benefits of the tax plans were false. Authorities alleged that damages from the scheme could be as much as $130 million in lost tax revenue since 2014.

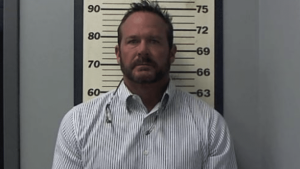

No stranger to legal trouble, Mardis was recently sentenced to 20 years in prison for severely beating his wife back in 2022. According to court documents, Kimberly Mardis, the spouse, suffered a fractured right ankle, a fractured left cheekbone, a lacerated liver, broken ribs, strangulation marks, extensive bruising, and hair pulled from her head as a result of the abuse.

Each year the IRS highlights some of the tax scams that put taxpayers at risk of losing money, personal information, data, and more. In the IRS’ most recent list, it specifically warned taxpayers “to beware of promoters peddling bogus tax schemes aimed at reducing taxes or avoiding them altogether.”