A trio of Mississippians are being held accountable for COVID relief fraud following an investigation by the IRS.

Five years after the enactment of the Coronavirus Aid, Relief, and Economic Security (CARES) Act, the IRS identified 2,039 tax and money laundering cases related to COVID fraud, with attempted fraud in these cases totaling $10 billion.

These cases include a broad range of criminal activity, including fraudulently obtained loans, credits, and payments meant for American workers, families, and small businesses. Among those investigated are three Mississippians, who are now having to face Lady Justice for their crimes.

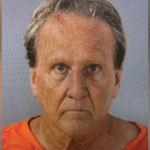

On January 15, Olive Branch natives Zipora Hudson and Montreal Hudson were convicted of conspiracy to commit wire fraud and conspiracy to commit money laundering following a federal jury trial. The two sought to fraudulently obtain federal loans intended to protect employees of endangered businesses during the pandemic. Sentencing for the two individuals is set for April 24.

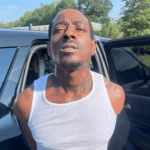

15 days after the Hudsons were convicted, Holly Springs native Lakisha Pearson, 48, was sentenced to four years in prison for mail fraud in connection with falsely claimed IRS Employee Retention Tax Credit for others. Pearson, who owns Unity Tax Express, pled guilty to using the internet to file false tax credit claims totaling nearly $47 million and taking kickbacks from those on behalf of whom she filed. She was ordered to pay $15,942,586 in restitution.

“Although it has been five years since the CARES Act was enacted by Congress, our special agents continue to follow leads, investigate, and forward for prosecution the individuals who defrauded the program,” IRS Criminal Investigation Special Agent in Charge Demetrius Hardeman with the Atlanta Field Office said.

“The CARES Act was an economic lifeline for businesses struggling during the pandemic. Every passing day, we are identifying the criminals who defrauded a program created to help businesses keep people employed during the COVID-19 pandemic.”

As of last month, the federal agency initiated 545 investigations, involving more than $5.6 billion in Employee Retention Credit fraud in tax years 2020, 2021, 2022, and 2023. 75 of the 545 investigations have resulted in federal charges. Thus far, 38 defendants in those cases have been convicted, with 18 defendants sentenced to an average of 21 months in prison.